Chapter 40

Engr. Abul KM Shamsuddin worked as Mine & Mine Environmental Specialist in Infrastructure Investment Facilitation Company (IIFC) & PricewaterCoopers of India Ltd (PwC) & Presented “Coal Sector Development Strategy” [PwC Report] of Bangladesh as Prepared for Mines & Mineral Development Project of Hydro Carbon Unit [HCU] of EMRD, Govt. of Bangladesh, Dhaka during July 2013:

PwC Report on Bangladesh Coal Sector Development Strategy

Presentation By:

Engr. Abul K. M. Shamsuddin;

Bangladesh Mining Consultant;

Mines & Minerals Development Project;

Hydro Carbon Unit (HCU), EMRD, Dhaka;

July 2013.

Terms of Reference (TOR)

- This report “Coal Sector Development Strategy” is prepared as part of the Mines and Minerals Development Project (Package # 07), Hydrocarbon Unit, Energy & Mineral Resource Division, Bangladesh.

- The Terms of Reference of this report is “To develop Coal Sector Development Strategy (including peat) with appropriate enabling frameworks for the public sector participation and institutional arrangements for the sector”.

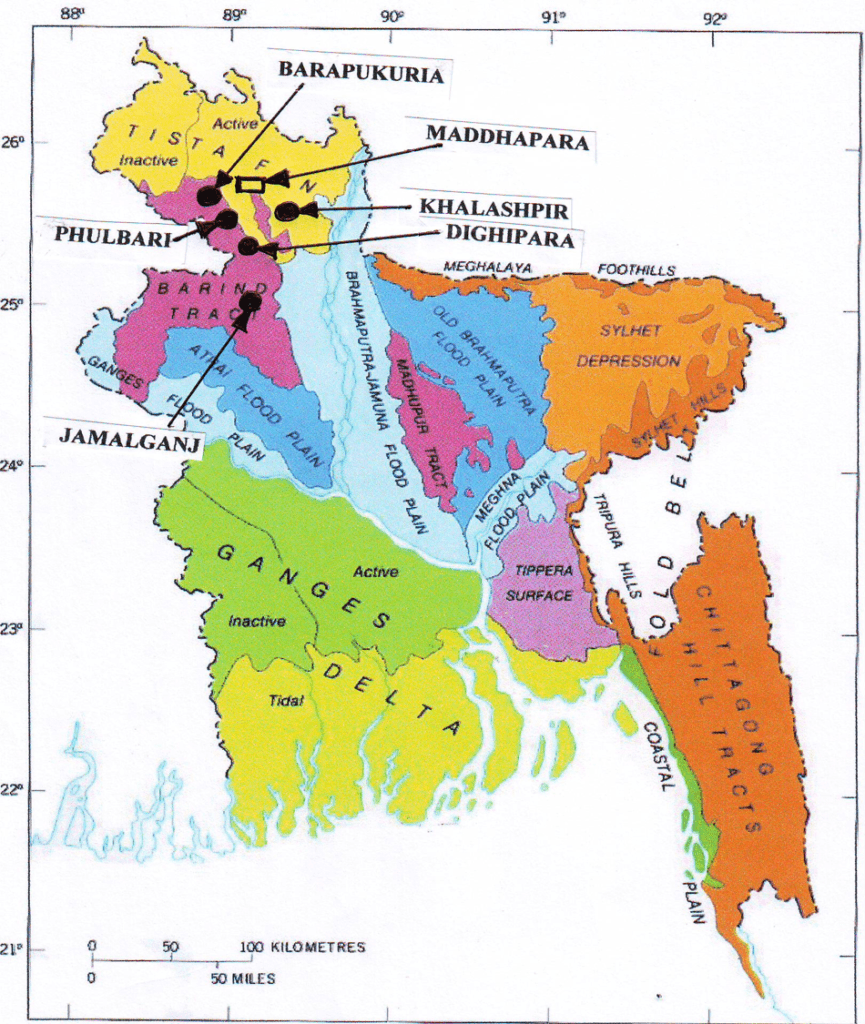

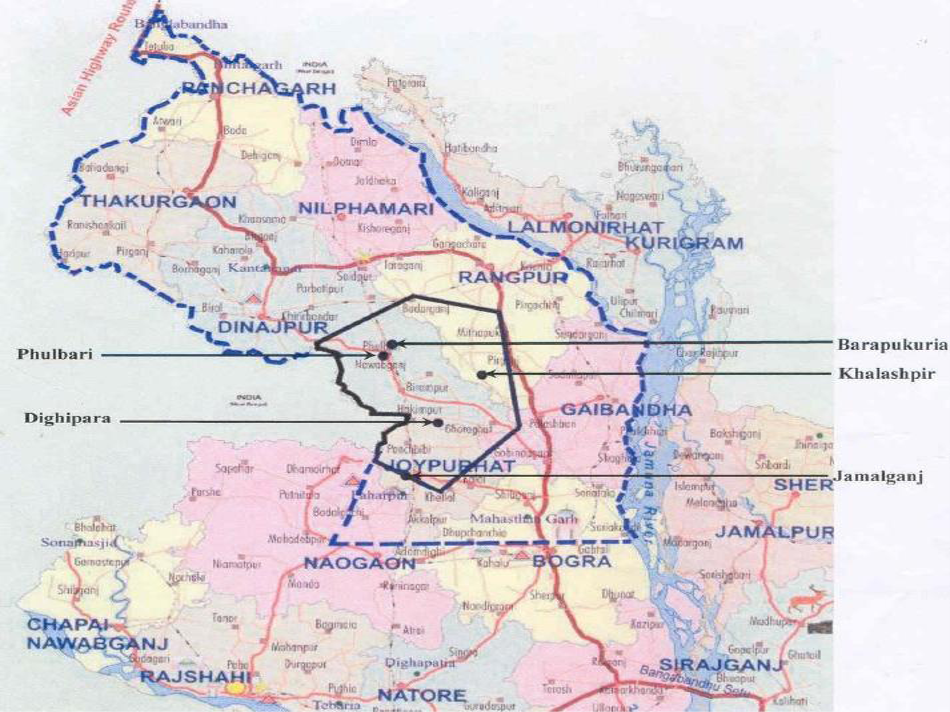

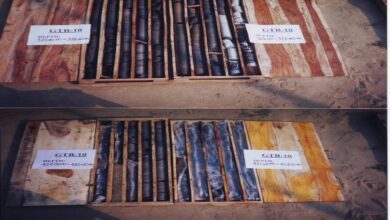

Coal Resources & Reserves

- The coal fields are located in the north western part of the country and have a geological linkage with the coal fields in the Assam and Raniganj area of West Bengal in India. Bangladesh has a total coal resource and reserve base of about 3.1 Billion Tonnes. Out of this total coal resources, around 13% (402.32 Mt) is under “proved” category, around 27% (839.90 Mt) is under “indicated” category and the balance about 60% (-1900 Mt) is under “inferred” category.

Demand & Supply Scenario of Coal-1

- The primary energy consumption in Bangladesh is 24.3 Mtoe (Million tonnes of oil equivalent) in 2011 representing 0.2% of global primary energy consumption, against a global population share of about 2.4%.

- Natural gas is the dominant primary commercial energy source for Bangladesh with over 3/4th share, followed by oil at 21%. Coal, despite its significant resources in the country, hydroelectricity and other power sources together contribute barely 3% of total commercial energy use.

- The Bangladesh Government is committed on a policy to make electricity available to all by 2021 and is targeting 600kWH per capita. To address power shortfall and meet the growing demand, the Govt. proposed initiatives to add about 11.8 GW generation capacities in next 5 years (2012-2016).

- With depleting gas reserves and current known resources, major alternative energy fuel available in Bangladesh is COAL. Coal has the potential to contribute to national economy by way of supplying energy for power generation, as well as for heat applications in industries.

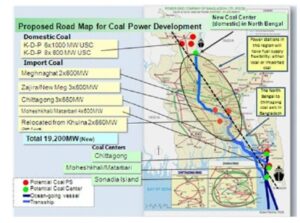

- Of the 33,708 MW power requirements by year 2030 (PSMP – 2010), the GoB plans to generate 20,000 MW using coal both domestic and imported.

- At present there is demand for coal from the 2X125MW coal fired power plants at Barapukuria, brickfields and other industries in Bangladesh. The Barapukuria Coal Mine operated by BCMCL is the only coal mine in Bangladesh.

- Therefore, immediate development of coal fields are needed, so that adequate coal is available before 2015 as an alternate commercial fuel for power generation.

Strategy for Development of Coal Deposits-1

- Additional drilling is required in bringing the entire resource of around 3.1 Billion Tonnes into “Proved” category.

- The detailed exploration and other studies along with preparation of geological reports and other reports of all the coal basins can be completed within a period of 3-4 years.

- The detailed exploration and other related studies should be funded by a State agency/PSU so that the geological reports and other reports become the properties of BMD and GSB. Thus GoB can fetch better returns on auctioning established reserves.

- The policies and strategy for development of coal mines should be framed keeping the following fundamental objectives in view to achieve the goal of sustainable development of the coal mining sector of the country:

- Maximization of conservation of coal resources.

- Attainment of highest level of safety in mines.

- Minimization of environmental damage to mining areas.

Investment Models & Financial Aspects

- Public Sector Investment:

- Coal mining is a high risk capital intensive industry. Considering the risk involved, Govt. may provide budgetary support in the form of equity or share capital to a public sector enterprise. The possibilities of getting financial assistance from multilateral funding agencies could also be explored.

- There are several routes to invite funds to invest – through direct investment (FDI), joint venture (JV), public private partnership (PPP), and production sharing contracts (PSC). The private sector investment in mining sector in Bangladesh has been limited due to the inadequate geological information about mineralization in the country.

- For ensuring the confidence of investors in the coal sector, it would be important to ensure that the financial and physical (transmission & distribution infrastructure) capacity of BPDB is strengthened to enable it to purchase the contracted quantities of coal on time from Coal Mining Company / Govt. Agency and make payment on time (considering that open market coal sales by private investors shall not be allowed and all products shall be sold to Govt. Agency as being done in Bangladesh Gas Sector).

- Involvement of the private sector could be through a public private partnership (PPP) arrangement under PSC specifically designed for the coal sector model using experience gained from gas sector. The selection of private partner may be done through ICB.

Contractual Issues

- Coal mining is a capital intensive industry and it is preferable to undertake a separate and exclusive study to examine different model and modalities of financing to choose the best option.

- Bangladesh should encourage the option of contract mining or joint development with experienced developers wherein the provisions are attractive for both parties (GoB and contractor / operator).

- Cost-plus contract: The contractor is responsible for development and operation of coal block. GoB, the owner, would allow a fixed profit based on percent of operating cost or amount per ton or percent of capital cost, etc.

- Levelised price contract: In such contracts, the contractor is fully responsible for development and operation of the coal block and the price at which coal is delivered is lump sump on per unit quantity delivered subject to escalation based on some pre-agreed formula (to accommodate change in cost structure due to inflation). In such condition, irrespective of actual cost of mining, owner pay fixed mining service fee to contractor. Since the fee payable by owner is not linked to cost; owner is insulated to any adverse impact on cost. Further, the owner may not need to monitor cost of operations. But the owner should check the compliance with rules and regulations.

- Profit sharing contract: The investor/contractor can be given due return on his investment for exploration and production of the coal, during mining operation and the profit coming out of the coal production shall be shared among the partners as is done in Perobangla’s production sharing contract in gas sector.

Taking into account the various types of coal contracts, as above, and the circumstances prevailing in Bangladesh as far as coal is concerned, a model coal PSC appropriate for attracting investment in the coal sector may be prepared. The contractor selection may be done by conducting international competitive bidding process.

Legal Framework

- In Bangladesh the principal laws enacted to regulate mineral sector were: The Mines Act, 1923 and the Mines and Minerals Act, 1967 (E.P. Act II of 1968). While the Mines Act, 1923 was amended in 2005, the Mines & Minerals (Regulation and Development) Act, 1967 was repealed in the year 1992 and was replaced by the Mines and Mineral Resources (Controlled & Development) Act 1992 (Act No 39 of 1992).

- The Mines & Minerals Rules, 1968 was framed under the Mines & Minerals (Regulation & Development) Act 1967, through which the GoB has delegated its authority to Bureau of Mineral Development (BMD) in the matters of regulating Exploration Licenses, Mining Leases and Quarry Leases. The Mines and Minerals Rules 1968 was subsequently amended in the years 1989, 1995, 1999 and 2004. PwC have studied in details the provisions of existing Acts, Rules & Regulations and has put forward the recommendations.

- Recommendations:

- It is necessary for sustainable development that the current legislations are amended and wherever required, new legislations are enacted to address issues related to technical management; ownerships of mineral resources, FDI, investment facilitation, royalty and taxation; Occupational Health & Safety (OH & S), fair wages and working conditions, etc.; social and environmental impacts of mining activities, etc.

- PwC’s recommendations broadly covers Amendments and additions in existing laws; Changes in licensing regime; Promulgation of new laws and authorities; Formulation of policies related to FDI, R & R.

Institutional Aspects

- As per the constitution of People’s Republic of Bangladesh, the ownership of its mineral wealth lies with the people of the country. Thus, on behalf of Bangladesh, the mineral and the mining sector is governed and controlled by the Ministry of Power, Energy and Mineral Resources (MoPEMR), GoB. The MoPEMR has got two major divisions: (a) Power and (b) Energy & Mineral Resources.

- Energy and Mineral Resources Division (EMRD) is the Ministry responsible for development and exploitation of Mineral Oil, Gas, Coal, Hard Rock and other mineral resources of Bangladesh. EMRD manages the business through two main corporations:

- Petrobangla – for Oil, Gas, Coal and Minerals

- Bangladesh Petroleum Corporation (BPC) for petroleum products.

- Petrobangla has number of subsidiary companies incorporated under Companies Act, 1994. Operations of these companies are monitored and supervised by Petrobangla. The pre-operating, monitoring and regulatory functions to be performed by Govt. like survey, exploration, administration and issuance of mining concessions or licenses and mining leases and other regulatory measures are performed by different agencies formed under EMRD namely – GSB (survey and exploration); BMD (mining license & leases); Department of Explosives (the safety during handling of explosives, gases, petroleum and other flammable liquids, combustible solids, etc.).

- It has been observed that the present system and organizations dealing with mines and minerals may not achieve the objective of focused exploration and development. Hence establishment of some new institutions are being proposed.

- These are:

- Coal Sector Development Unit (CSDU);

- National Mines and Minerals Council;

- The Ministry of Mines and Mineral Resources;

- Coal Bangla;

- Khani Bangla;

- Inspectorate of Mines and Minerals;

- Department of Mining Engineering at University;

- Bangladesh Mining Institute.

Human Resources and Management-1

- Skilled manpower in Bangladesh Mining Sector is very limited. The proposed mines need skilled labor force to work efficiently with costly mining machinery in a totally unknown and unfamiliar atmosphere deep underground. As setting up a fully fledged educational institute may take time, for more skilled jobs like management of operations and planning, supervision of mines, etc. GoB may consider setting up of Vocational training institute which will provide regular trainings to the people deployed in the mines and will also undertake skill development courses for new manpower deployed at mine operational level.

- Institute may consider tie-ups and exchange programs with renowned mining institutions to strengthen their curriculum and academic level. Setting up of new institute to offer education in disciplines like mining engineering, geology, mineral processing engineering etc. may be considered. The mining courses offered should integrate mining related IT education.

- Bilateral agreements for sharing of technology and knowledge with countries which are rich in mineral resources and have a well established mining industry shall be beneficial to Bangladesh.

- Contracts entered with the foreign developers and operators should have provisions of knowledge sharing and skill and technology transfer.

- A coal training fund may be set up, similar to existing gas sector training fund, financed by contributions from private investors in coal mining.

Coal Sector Infrastructure Development

- It is proposed that the area comprising the discovered coal fields and potential coal basins in northwestern Bangladesh may be declared as “Coal Zone”. The Coal Zone may be formed taking into consideration, the entire socio-economic structure in the region. In order to ensure proper planning of the entire area with respect to the infrastructure requirements, a Coal Zone Study is to be undertaken by involving relevant authorities.

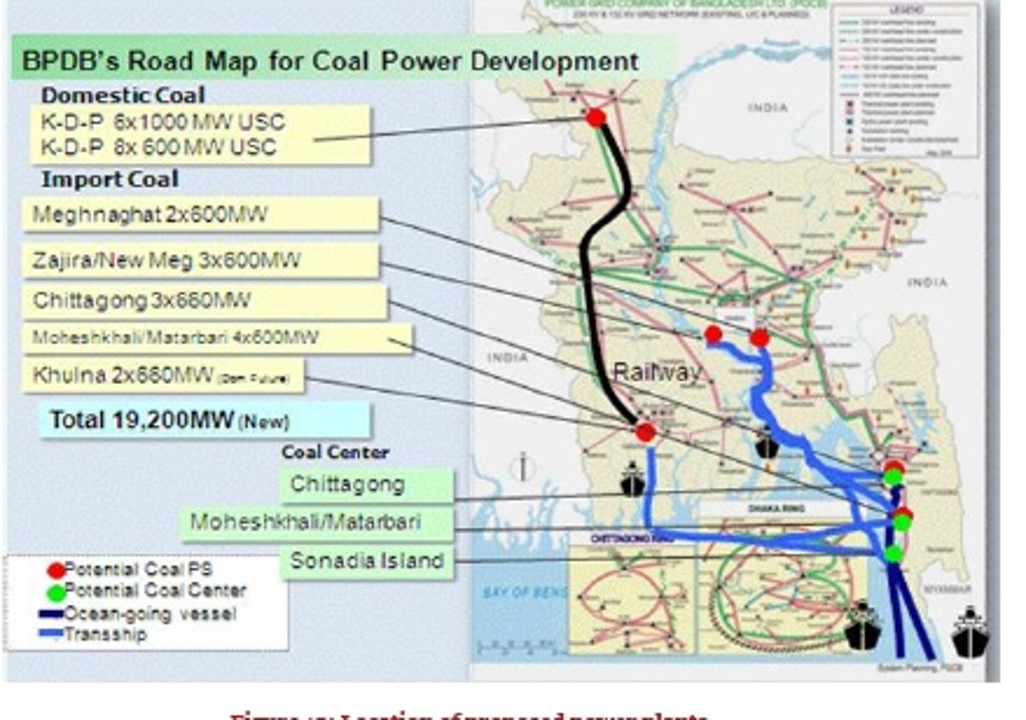

- Coal Axis should be given due consideration to define a route for development of coal transportation system across the Bangladesh. Its viability (or otherwise) should be established through a techno-economic study by relevant experts. Coal axis is to be used as principle region for locating the major coal fired power stations in Bangladesh such that they have the flexibility to use both local and imported coal.

- The infrastructural development for coal production and supply must ensure that transportation cost is kept at minimum with maximum capacity utilization of the facilities. The river routes must be given top priority for coal transportation in addition to the improvement in road and railway modes.

Coal Depletion and Pricing Policy

- To ensure long term energy security of Bangladesh it is desirable that the limited reserves of coal are depleted in a planned manner over a long period of time with a vision of coal conservations and maximum exploitation. Therefore there must be a depletion policy which specifies the period over which an existing reserve would be fully mined, say for example 30-50 years. It should be encouraged that power plants use imported coal. Emphasis may be given to develop peat as domestic fuel than coal to conserve coal for higher value usage. Further, techno-economic feasibility of blending peat with coal should be explored.

- Coal pricing may be revisited to represent a realistic scenario making the return to the investors keeping the coal price tolerable. Setting up Coal Price Equalization Fund (CPEF) may be considered.

Land Utilization and Reclamation

- The Mine Plan and the PSC/Mining Contract, if there is one, must make it obligatory for the mine owners to reclaim and rehabilitate the mining area after mine closure as per the mine plan to the extent feasible. Adequate safeguards need to be built in to the lease documents (and PSC) so that it can be enforced.

- A policy may be framed to deal with the rehabilitated land so that while fair play is assured to the lessee, the Govt. steps in to avoid windfall gains to the lessee by imposing a suitable tax.

Role of Peat

- Peat deposits occur in marshy areas of the north-eastern, central and south western parts with a total reserve of more than 170 million tons. Calorific value of peat ranges from 6000 to 7000 BTU/lb (3334 to 3889 Kcal/Kg). Peat can be used as fuel for domestic purposes, brick manufacturing, boilers, etc.

- Recommendations for using Peat:

- Detailed surveys to confirm the reserves of peat from the category of resource be carried out.

- Undertake studies to utilize peat for Power Generation.

- Undertake TEFS in the areas having proven reserve.

- Invite bids for setting up 20-25 MW power stations near the peat fields and award of mining lease.

- Peat deposits may be divided into blocks and need not to be linked to setting up power stations.

- Encourage local entrepreneurs to set up units for producing briquettes from peat for domestic and other use and popularize it.

- Conduct research for use of peat as a fertilizer and / or soil conditioner for agriculture and horticulture sector and also for fisheries and water treatment and / or purification.

- Frame separate rules for leasing and land acquisition, lease or purchase specifically to suit peat mining operations in Bangladesh.

[End of the Presentation by Engr. Abul K. M. Shamsuddin]