Chapter 28

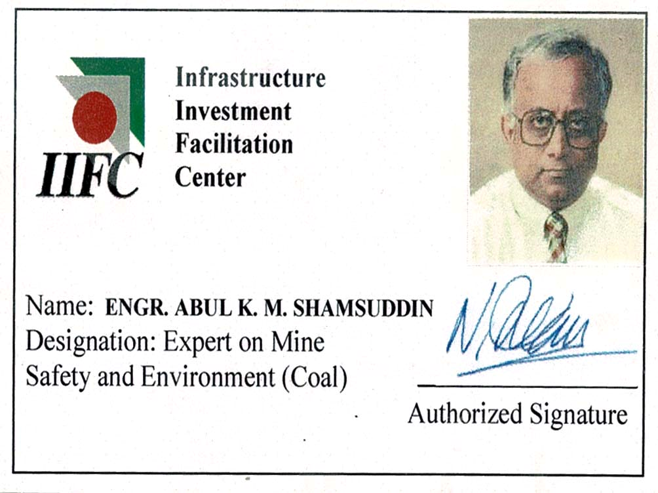

Engr. Abul KM Shamsuddin worked as Hard Rock Mining Specialist & Team Leader for “Market Feasibility Study of Maddhapara Hard Rock of MGMCL, Petrobangla” made by Infrastructure Investment Facilitation Company (IIFC), a wing of Internal Resource Division (IRD), Ministry of Finance, Govt. of Bangladesh during 2016.

Maddhapara Granite Mining Company Limited (MGMCL)

Market Feasibility Study of Hard Rock of MGMCL

Presentation on Draft Final Report

Infrastructure Investment Facilitation Company

Presented by Engr. Abul KM Shamsuddin, Team Leader, IIFC Consulting Team.

13 October 2016

MARKET FEASIBILITY STUDY OF HARD ROCK OF MGMCL

Power Point Presentation of Final Report

October 2016

Part – A: Market Prospects of Hard Rock and Recommendations.

Presentation by:

Engr Abul KM Shamsuddin; Hard Rock Mining Specialist & Team Leader.

Engr Md. Ahsan Zakir; Technical Expert.

Part – B: Current Situation, MGMCL ‘s Marketing Strategy.

Presentation by:

Khaled Mahmud; Financial Expert & Analyst.

Md. Shariful Islam; Project Cordinator.

HARD ROCK MARKET PROSPECTS & CONCLUSIONS AND RECOMMENDATIONS

PRESENTATION By:

Engr Abul KM Shamsuddin;

Hard Rock Mining Specialist & The Team Leader;

ENGR md AHSAN ZAKIR;

Technical Expert;

Market Feasibility Study of Hard Rock of MGMCL

Market Prospects in Public Sector

- ECNEC Decision on Public Procurement

- A decision has been taken in the ECNEC meeting held on 2 March 2010, that in case of public procurement, government companies will get preference to procure goods and materials from the other government companies who produce the products on priority basis.

- In this context, the consulting team visited some major government enterprises to assess their requirements of rock.

MAJOR POTENTIAL CUSTOMER

- It is observed that a big market of hard rock exists in Bangladesh. The major potential customers are as follows:

- Ruppur Nuclear Power Plant

- Padma Bridge

- Jamuna Bridge

- Bangladesh Railway

- Roads and Highways

- LGED

- Water Development Board

- Power Development Board

- Bangladesh Army

- Bangladesh National Airports

- Cox’s Bazaar International Airport

- Proposed Saidpur International airport

- Dhaka Mass Transit Company Ltd.

- Kornophuli Tunnel

- Bangabandhu International Airport

- Payra 1320 MW Thermal Power Project

- Out of these fifteen major potential customers the consulting team has identified and visited the following organizations that presently either uses or will be using boulder, crush stone and stone dusts as construction materials:

- Bangladesh Railway

- Bangladesh Bridge Authority

- Local Government Engineering Department (LGED)

- Roads and Highways

- Dhaka Mass Transit Company Ltd.

- Ruppur Nuclear Power Plant

- Payra 1320 MW Thermal Power Project

Bangladesh Railway (BR)

- The consultant team visited different installations of Bangladesh Railway in Dhaka, Saidpur and other places. It has been observed that there is a huge demand of hard rock/boulders/crush stone/stone dust in BD Railway. The consultant team has observed that about 60% of ballast is imported and the rest are from the local sources.

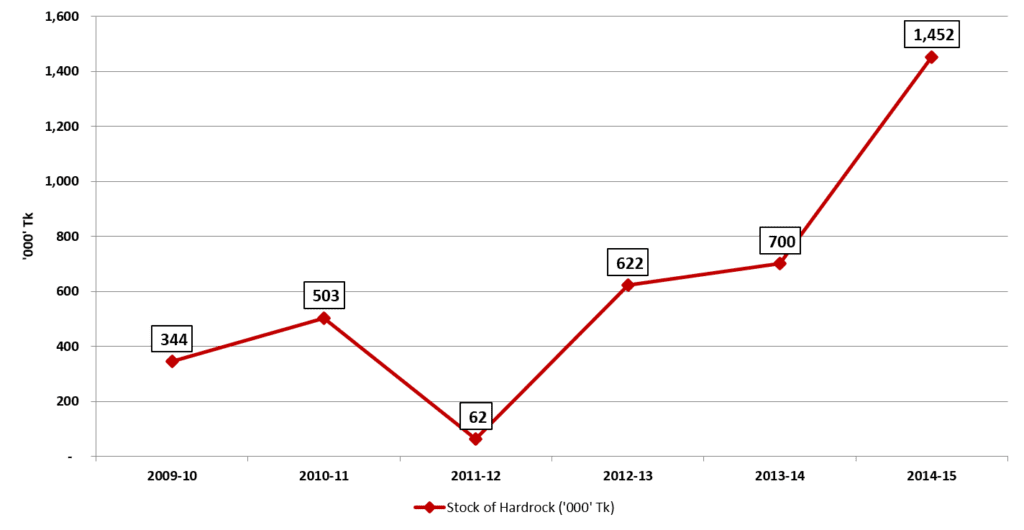

- It is our considered opinion that for marketing of stone in Bangladesh Railway, production has to be uninterrupted from the hard rock mine and there must be sufficient stock in hand so that instant supply /delivery can be made to meet the demand of the customer.

- There are other problems in the context of Marketing with BR which has been described in the Draft Final Report.

- Possible remedial measures have also been suggested in the report.

Discussion with Bangladesh Railway about transportation of Railway Ballast:

- A meeting with Bangladesh Railway was held on 10 October 2016 to discuss about the mode of transportation using railway wagon through Bangabandhu Bridge over River Jamuna.

- Since there is a huge demand of Maddhapara Hard Rock in Bangladesh Railway – BR is interested to use Maddhapara Hard Rock in their ongoing projects. DG Railway informed the meeting that on-going projects need about 2.0 crore cft of crushed stones during 2016-2023.

- DG Bangladesh Railway and M. D. MGMCL agreed to continue the discussion further and ultimately to sign a MOU for easing transportation by railway.

Bangladesh Bridge Authority

- BBA does not procure any material directly from the suppliers. They tender out their works and the contractors procure materials from different suppliers according to the BBA specifications.

- Almost 50 – 60 lac Metric Ton hard rock will be needed in the next five years for their mega projects like Padma Bride, Dhaka Elevated Expressway, Kornophuli Tunnel, Dhaka-Ashulia Expressway.

- BBA is interested in using the country resources instead of the imported resources if the resources meet the international standard/specifications.

The BBA officials suggested the following for Maddhapara hard rock:

- price of the hard rock should be adjusted to the market price.

- ensure the supply of hard rock as and when necessary.

- It is felt by the consulting team that there is a huge demand of boulder/crushed stone/stone dust in Bangladesh Bridge Authority’s development program. In this context, we recommend that MGMCL should have a wider discussion with the Bridge Authority to meet the above demand/requirements of BBA.

Padma Multipurpose Bridge Project:

- Construction of Padma Bridge will require around 70.0 lakh tonnes of big-sized hard rock in next four years (2017-2020) as follows:

- Year-1: 2017 – 15.0 lakh tonnes;

- Year-2: 2018 – 17.0 lakh tonnes;

- Year-3: 2019 – 19.0 lakh tonnes;

- Year-4: 2020 – 19.0 lakh tonnes;

- TOTAL = 70.00 lakh tonnes of big-sized hard rock.

- MGMCL’s hard rock meets the criteria of requirements of Padma Bridge. MGMCL may take all-out efforts to capture the above market.

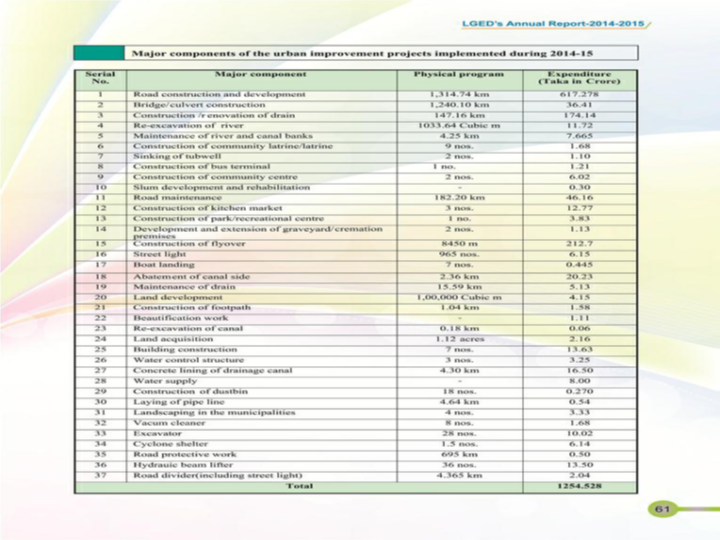

Local Government and Engineering Department (LGED)

- The Head Office of LGED does not conduct any tender. All tender works are decentralized to the district’s office of LGED.

- LGED does not procure any material directly from the suppliers. They tender out their works and the contractors procure materials from different suppliers according to the LGED specifications.

- All the Parishads like Zila Parishad, Upazilla Parishad, Union Parishad, Pourashava also follow their rate schedule as standard.

- LGED has given preferences to the Maddhapara hard rock in their rate schedule of the tender documents.

- The LGED officials suggested the followings for Maddhapara hard rock

- supply process of Maddhapara hard rock should be easy

- price of the hard rock should be at least equal to the market price

- It is felt by the consulting team that there is a huge demand of boulder/crushed stone/stone dust in LGED’s development program. In this context, we recommend that MGMCL should have a wider discussion with the LGED to meet their demand.

Roads and Highways Department

- RHD does not procure any material directly from the suppliers. They tender out their works and the conductors procure materials from different suppliers according to the RHD specifications.

- RHD has given permission to the Additional Chief Engineer, RHD, Rajshahi Zone for procurement of crushed stone (5-20 mm size) directly from MGMCL.

- MGMCL may contact CE, RHD, Rajshahi Zone for the purpose.

- The RHD officials suggested the followings for Maddhapara hard rock

- MGMCL sells their hard rock through the listed dealer, which effect on the price and delivery time. This system creates problems for the procuring entity. It should be sold directly to the procuring entity by MGMCL

- Price of the hard rock should be at least equal to the market price

- It is felt by the consulting team that there is a huge demand of boulder/crushed stone/stone dust in RHD’s development program. In this context, we recommend that MGMCL should have a wider discussion with the RHD to meet the above demand/requirements of RHD.

- Since quality and composition of Maddhapara Hard Rock are of international standard – RHD is keen to use MGMCL stone. RHD follow Govt. Procurement Rules in purchasing boulders, crushed stone, stone dust.

- RHD commented that if Govt. makes it mandatory for us to procure Maddhapara products – it will be easy for us to procure directly from MGMCL.

- MGMCL may proceed accordingly.

Dhaka Mass Transit Company Ltd.

Construction of MTC from Uttra to Motijheel will start from June/July 2017. Length of the route will be 20km and breadth 19m and there will be 16 Stations. It will be elevated track of 13 m from the ground. There is a provision of Depot / Workshop for rolling stocks with an area of 25 hectors. This is a huge construction work. Now work is under process to call tender. MGMCL may meet the Project Officials /Consultants explaining the quality and composition of Maddhapara stone for use in the construction works.

Rooppur Nuclear Power Project

- The Rooppur Nuclear Power Project will be having a very massive Infrastructure Development Work. Maddhapara Boulders / Crushed Stone / Stone Dusts can be utilized, as construction materials, in Rooppur NPP development work.

- It is our considered opinion that MGMCL / Petrobangla / MOEMR may have bilateral meetings with ROOPPUR Power Plant Project / Bangladesh Atomic Energy Commission / Ministry of Science & Technology about the utilization of Maddhapara Hard Rock in Rooppur Project. After signing of the MOU – Maddhapara Mine can be developed to meet the Rooppur demand.

- Further details are in the Final Report.

Payra 1320MW Thermal Power Project

- ECNEC approved Development Project Proposal (DPP) of Payra 1320 MW Thermal Power Project, its Land Acquisition, Land Development and Protection on October 21, 2014. The main part of the project is land acquisition (1000 acre), land development, embankment, earth protection (9.0 km), approach road (3.5 km), rehabilitation and resettlement. All these development works need Maddhapara Boulders, Crushed Stone, Stone Dust/Chips, etc. MGMCL may pursue the Payra 1320 MW Thermal Power Project Authority for the utilization of Maddhapara Hard Rock.

- There are rail route and river route for transportation of Hard Rock / Boulders / Crushed Stone / Stone Dust from MGMCL to Payra Project.

Parallel Bridge with Bangabandhu Bridge – a huge Market for Maddhapara Stone

- BR was a regular customer of MGMCL and suffered due to failure of stone supply. Even then BR is interested again if BR gets confidence that MGMCL will be able to maintain their supply commitment in time. From the Development Program of BR it is seen that always they require huge quantity of stone at least for next 10(ten) years. As there is loading restriction for railway over existing Bangabandhu Bridge, another bridge adjacent to this bridge will be constructed only for railway with the financial assistance of JICA.

- MGMCL must take the opportunity to supply stone for this bridge. Dhaka Transport Coordination Authority (DTCA) has prepared a Master Plan up to 2035 for Dhaka with its adjacent City/ Districts which has been approved in the Cabinet Division on August 29, 2016. This area can also be explored by MGMCL for marketing.

Locally Produced Stone Chips from Private Quarries:

- Shripur Construction Stone Quarry: Stone Produced in 2014= 2,205,728 cft.

- Kanaighat Stone Quarry: Stone Produced in 2014 = 2,205,728 cft.

- Bholaganj Quarry: Stone Produced in 2014 = 15,475,597 cft.

- Utma Quarry: Stone Produced during 2013-2014 = 1,001,028 cft.

- Shah Arefin Tila: Stone produced in 2013-14 = 163,611 cft.

- Ratnapur: Stone produced during 2013-2014 = 27,117 cft.

- Jaflong Rock Stone Quarry; Stone produced in 2014: 14,262,263 cft.

- Bichanakandi: Stone produced during 2013-14: 4,374,491 cft.

The above mentioned private quarries pay royalty to Govt. at the rate of taka 1.96/cft. Royalties are collected on the basis of loaded truck or boat. These stones are extracted from river bed and flood plains in a non conventional manner and without considering environmental systems and guidelines. There is very poor monitoring from Bureau of Mineral Development (BMD) and Department of Environment (DOE). Moreover – the quality of stones are poor and inferior.

Annual productions from these quarries are around 5-6 million cft. i.e. about 3.o lakh ton.

- News paper article sources say that – about 3.0 lakh tons of stone chips are exported to India annually.

- Demand for locally produced stone chips increased as the construction stone has been exported to Meghalaya and Tripura in the crushed form due to transportation and cheaper labor cost in Bangladesh.

- Part of the export is dependent on imported boulders from Meghalaya State of India.

- These non-conventional and not environmentally friendly manner stone extraction should be stopped.

- MGMCL can produce and supply these stones.

- [Ref: E & P Journal; Issue: June 16, 2016].

MGMCL’S STONE, GRADE, PRICE, USERS

|

Organization |

Year-1 (2017) |

Year-2 (2018) |

Year-3 (2019) |

Year-4 (2020) |

Year-5 (2021) |

|

Bangladesh Railway |

1.70 |

2.04 |

2.45 |

2.94 |

3.53 |

|

BBA (Padma Bridge) |

15.00 |

17.00 |

19.00 |

19.00 |

BBA Web Site |

|

LGED |

5.00 |

6.00 |

7.20 |

8.64 |

10.37 |

|

R & H Deptt |

5.00 |

2.00 |

2.50 |

2.00 |

1.00 |

|

Dhaka Mass Transit Co |

0.50 |

0.50 |

0.50 |

0.50 |

|

|

Payara 1320 MW Thermal Power Plant |

5.00 |

5.00 |

5.00 |

5.00 |

5-year Demand in chips in major public organizations that Consulting Team Visited

|

Organization |

Year-1 (2017) |

Year-2 (2018) |

Year-3 (2018) |

Year-4 (2019) |

Year-5 (2020) |

Remarks |

|

Bangladesh Railway |

1.70 |

2.04 |

2.45 |

2.94 |

3.53 |

Assuming 20% annual growth rate |

|

BBA Padma Bridge |

15.00 |

17.00 |

19.00 |

19.00 |

– |

Considering only road construction |

|

LGED |

5.00 |

6.00 |

7.20 |

8.64 |

10.37 |

Considering only road construction and assuming 20% annual growth rate |

|

R&H Department |

5.00 |

2.00 |

2.50 |

2.00 |

1.00 |

R&D Needs Report 2015-16 |

|

Dhaka Mass Transit Company |

0.50 |

0.50 |

0.50 |

0.50 |

– |

20 km long elevated roadway (From Dhaka Mass Transit Company) |

|

Pyara 1320 MW Thermal Power Plant |

5.00 |

5.00 |

5.00 |

5.00 |

– |

Energy & Power Journal, June 2016 |

|

TOTAL (in Lakh Ton) |

32.32 |

32.54 |

36.65 |

38.00 |

14.80 |

|

|

TOTAL (in M Ton) |

3.23 |

3.25 |

3.67 |

3.80 |

1.48 |

10-YEAR DEMAND IN BANGLADESH (FIGURES IN MILLION TONNES)

|

YEAR |

APPROXIMATE DEMAND |

|

2017 |

7.00 |

|

2018 |

8.05 |

|

2019 |

9.26 |

|

2020 |

10.65 |

|

2021 |

12.24 |

|

2022 |

14.08 |

|

2023 |

16.19 |

|

2024 |

18.62 |

|

2025 |

21.41 |

|

2026 |

24.63 |

Conclusions and Recommendations

Development of Existing Maddhapara Hard Rock Mine:

823

Since there is a huge demand of hard rock in the country, the production capacity of the existing mine should be enhanced through further development of the mine in a systematic and planned manner.

MGMCL may take necessary measures accordingly.

Transportation and Supply

Transportation and supply are prime needs for efficient marketing of rock. Stones are being carried through truck lorry. Transportation of stone through truck lorry is costly. Cost can be reduced if it is carried by railway. In case of Maddhapara hard rock, railway may be the main mode of transport.

Possible arrangement with Bangladesh Railway:

It is observed that BR has some old open wagons lying unused in different railway yards which need to repair. MGMCL may request BR to carry stones by repairing the above old wagons.

Boulders / Crushed Stone / Stone Chips are to sell from Mine-Mouth:

All boulders / crushed stone / stone chips should be sold from Mine-Mouth Store Yard. The Store-Yard at mine-mouth should have space of 3-month’s production capacity. It will not be economical to construct any infrastructure for stocking stone in different/several places. Any store-yard outside the mine premises will require additional cost in terms of land, man power, maintenance, security and theft from miscreants. Price will vary from one place to another. Even in the same point sale price may vary due to mode of transport i.e. train/by road. So sale of stone is recommended at Mine Mouth.

Final Concluding Remark

Finally it is concluded that – a developing country like Bangladesh needs Hard Rock in the form of Boulders / Crushed Stone / Stone Dust for the development of its Infrastructures including construction of Roads and Highways, Bridges, Culverts, High Rise Buildings, Apartments, River Embankments, Railway Ballast, River Training, Tunnels (Surface & Underground), etc.

Final Concluding Remark

Therefore, there is a huge demand of hard rock in the country. And Bangladesh has got substantial deposit of good quality Hard Rock in Maddhapara. Now, it is required to assess the demand for 25-30 years. To meet the demand, the production capacity of the existing mine should be enhanced systematically in a planned way through further development of the mine.

Mine development

To meet the above demands the Maddhapara Hard Rock Mine is to be developed. But before that it is required to have the marketing proposal from the above six users. This is our considered opinion that the MGMCL should try to have the demand from the client in line with the target production as set in the contract between MGMCL and Germania Trest Consortium (GTC) dated 2nd September 2013,which are as follows:

1st Year = 9.0 lakh metric tons; 2nd Year = 14.0 lakh metric tons; 3rd Year = 16.0 lakh metric tons; 4th year = 17.0 lakh metric tons; 5th year = 18.00 lakh metric tons; 6th year = 18.00 lakh metric tons.

MGMCL should focus on giving production as targeted in the GTC-MGMCL Contract.

To meet the rest of the demand including another nine organizations – MGMCL may have discussions with those organizations to have the market which is very large. To meet those demands –Maddhapara Hard Rock Mine should be developed horizontally / laterally in all the 4-directions i.e north-south-east-west, keeping the existing shafts in the central position. The mine should not be developed vertically / longitudinally, under any circumstances, for greater safety of the mine in terms of environmental, hydrological, and subsidence considerations.

A study on mine planning and development may be undertaken considering bright prospects of Maddhapara Granite, Granodiorite, Gneiss. Since the mine plan and design study is beyond the scope of the present market feasibility study- we recommend to take up a study on Mine Planning and Design on long term basis.

Environment Impact Assessment of Maddhapara Hard Mine

Maddhapara mine requires to conduct Environmental Impact Studies as the Environmental Conservation Rules 1997 stipulates that all mining projects belong to ‘Red Category’ industries. Therefore, the mining authorities need to prepare the Environmental Impact Assessment Report, Environmental Management Plan and Plan for Waste Disposal along with other documents for obtaining environmental clearance from the Department of Environment, Government of Bangladesh. At the same time the mining authority needs to establish regular control for water, air, soil quality for the areas.

Part – B:

Current Situation, Marketing Strategy and Guideline for Implementation

Discussion Agenda

- Activity Performance Analysis of MGMCL

- Why MGMCL is Facing Loss

- Strategy and Implementation Guideline

- Recommendation Summary

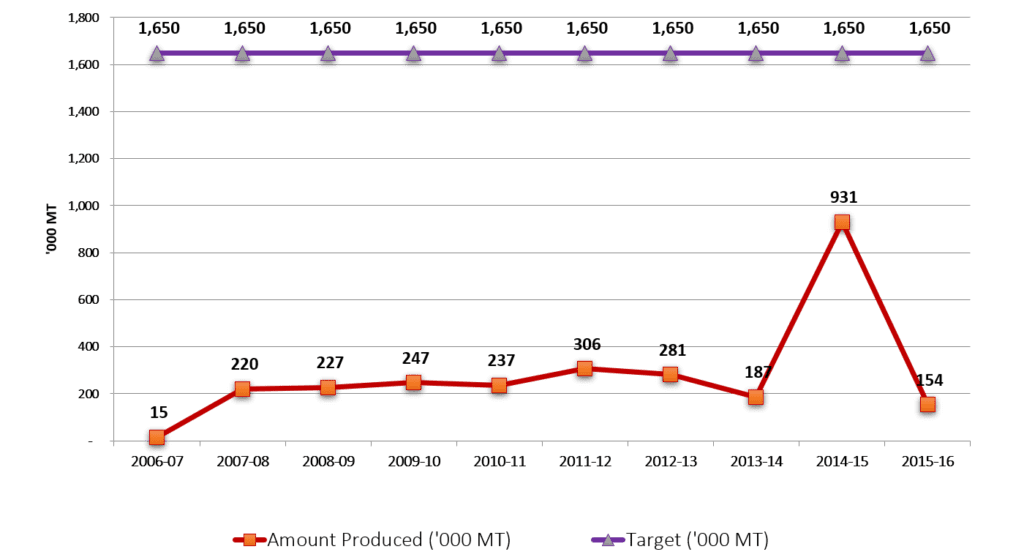

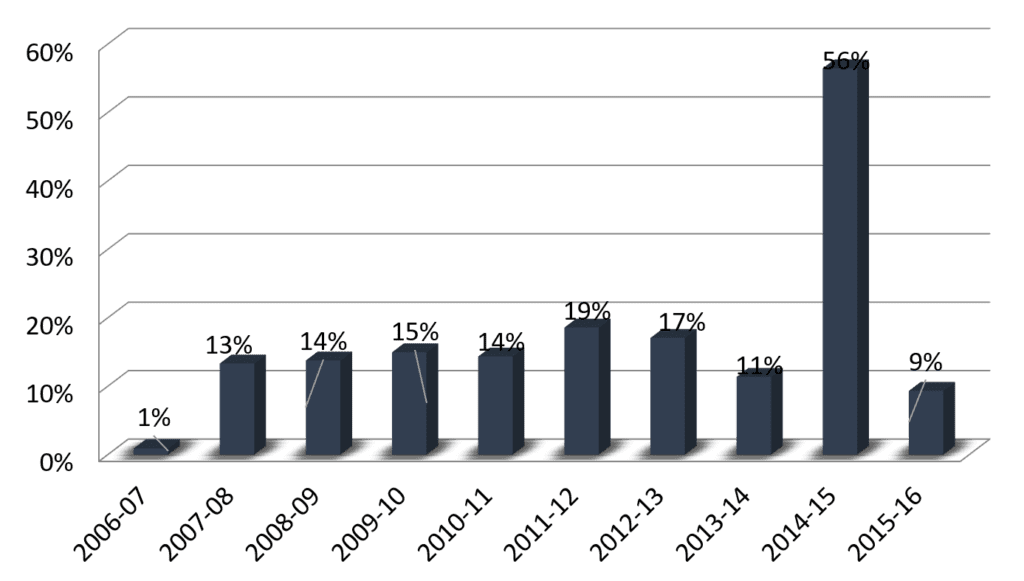

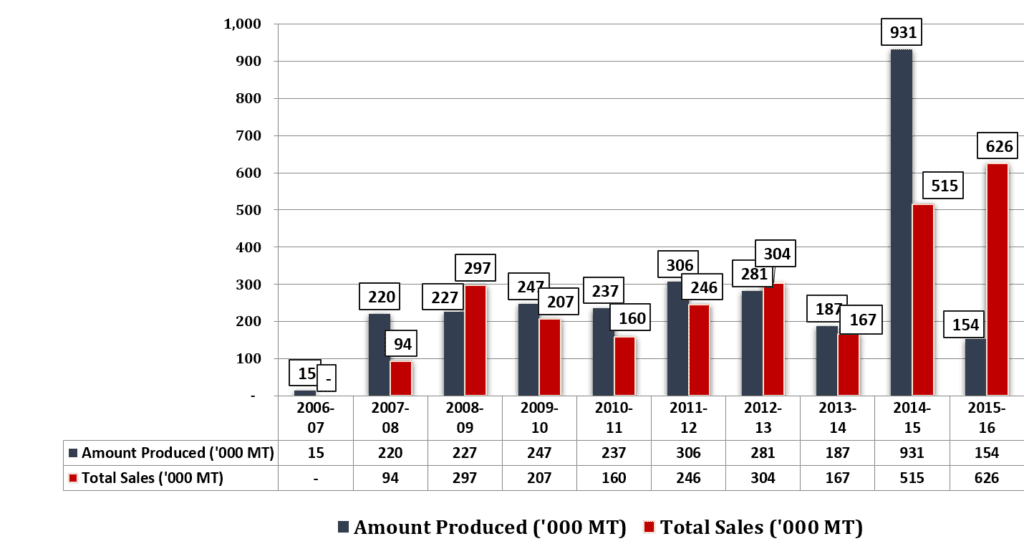

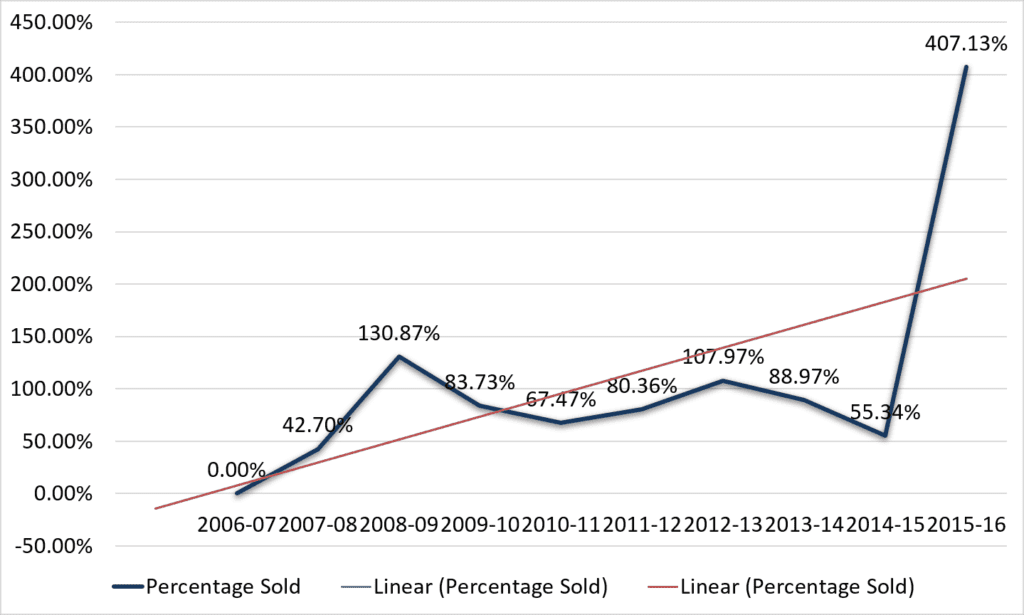

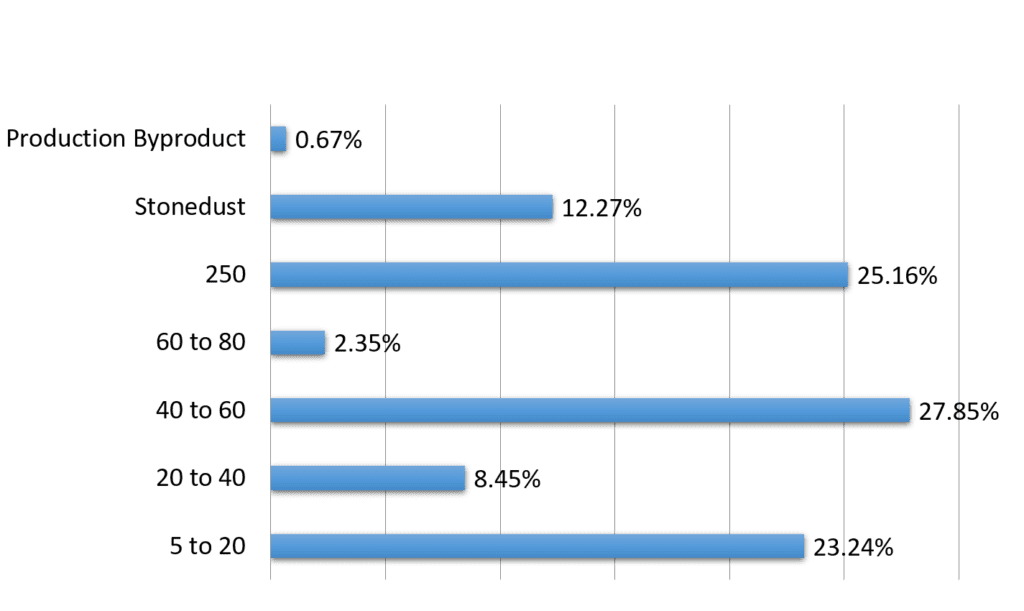

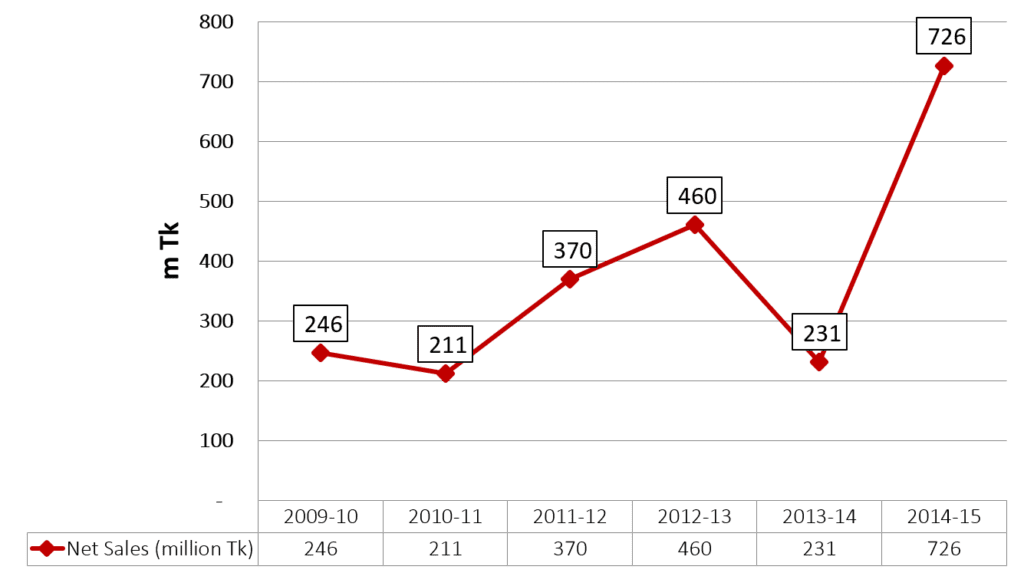

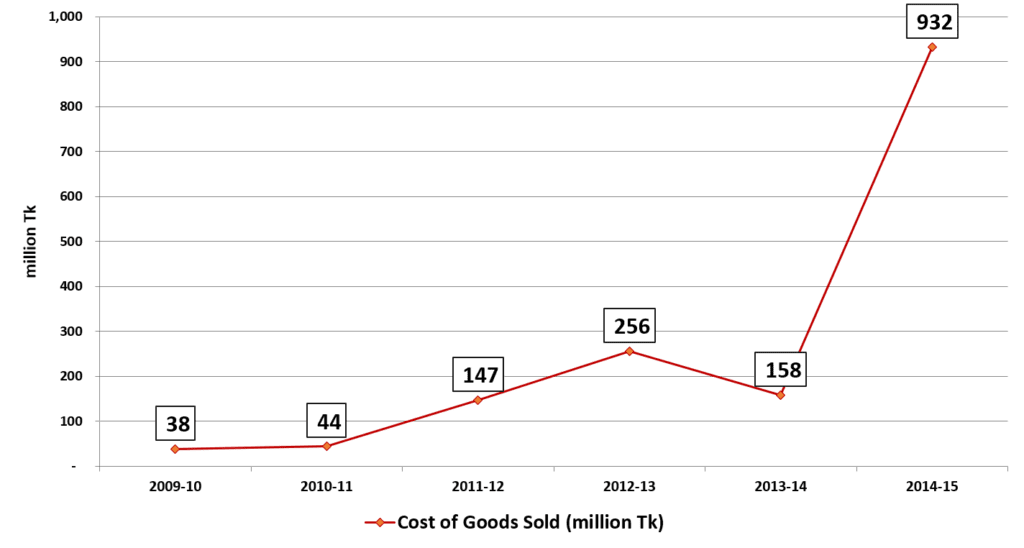

Activity Performance Analysis of MGMCL

Stone Sizes & Prices

|

Category |

Size |

Price |

Uses |

|

Boulders |

250mm and above |

USD 25 per ton |

River Training & Embankment |

|

Crushed Stone: |

60mm – 80mm 40mm – 60mm 20mm – 40mm |

USD 22 per ton USD 28 per ton USD 23 per ton |

Road & Railway |

|

5mm – 20mm |

USD 30 per ton |

Road, Bridge & Heavy Construction |

|

|

Stone Dust |

00mm – 05mm |

USD 5.00 per ton. |

Ingredient of Cement |

Price Comparison with Imported Rock

|

Category |

Product/ SKU |

Maddhapara Price (USD) |

Import Price (USD) |

|||

|

Maddhapara Operating |

Maddhapara out of operation |

|||||

|

Lower Range |

Upper Range |

Lower Range |

Upper Range |

|||

|

Boulder |

Boulder (>250mm) |

25.00 |

22.50 |

24.50 |

31.00 |

34.00 |

|

Crushed |

Crushed (5-20mm) |

30.00 |

27.00 |

29.00 |

33.00 |

36.00 |

|

Crushed (20-40mm) |

23.00 |

21.00 |

23.00 |

27.00 |

29.00 |

|

|

Crushed (40-60mm) |

28.00 |

26.50 |

28.00 |

32.00 |

35.00 |

|

|

Crushed (60-80mm) |

22.00 |

20.00 |

21.50 |

26.00 |

28.00 |

|

|

Stone dust |

Dust (0-5mm) |

5.00 |

4.50 |

5.00 |

6.00 |

7.00 |

Key Private Customers

Total 21 Customers, Top 7 are Presented Here (2014-15)

|

Sl. |

Name of Organization |

Dealer/ Direct Buyer |

Percentage of Total Sold Amount |

|

1 |

Abdul Monem Ltd. |

Dealer |

23.1% |

|

2 |

Bashundhara Cement |

Direct |

17.8% |

|

3 |

Meghna Cement |

Direct |

12.6% |

|

4 |

Nag Traders |

Dealer |

8.7% |

|

5 |

MZ Obaydul Haque |

Dealer |

6.3% |

|

6 |

Three Stars |

Dealer |

5.8% |

|

7 |

Ataur Rahman Khan |

Dealer |

5.5% |

|

79.80 % |

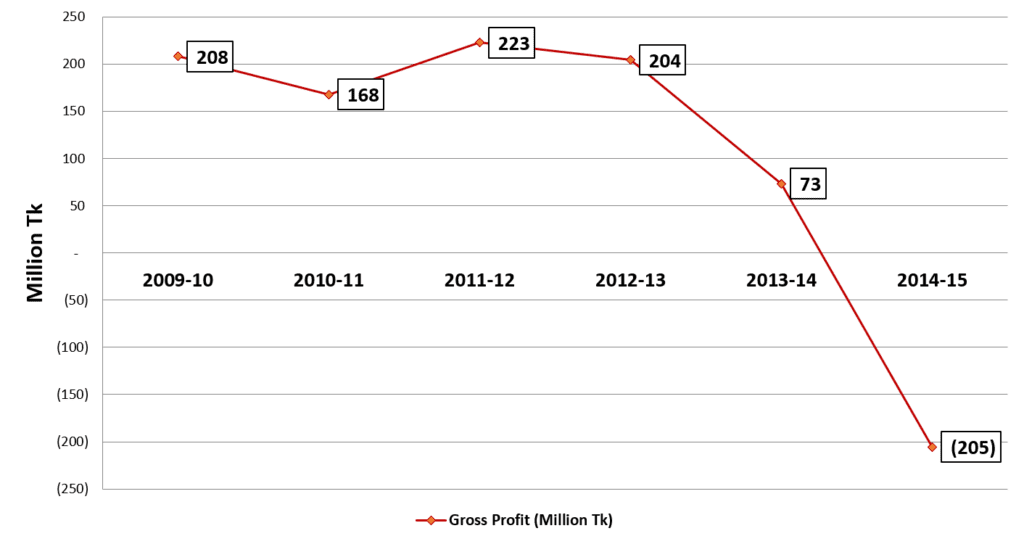

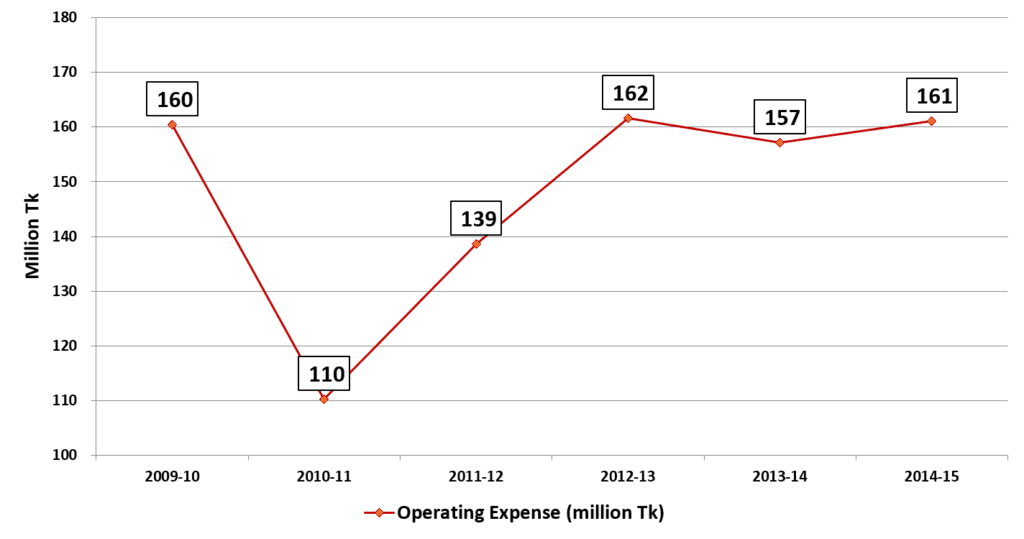

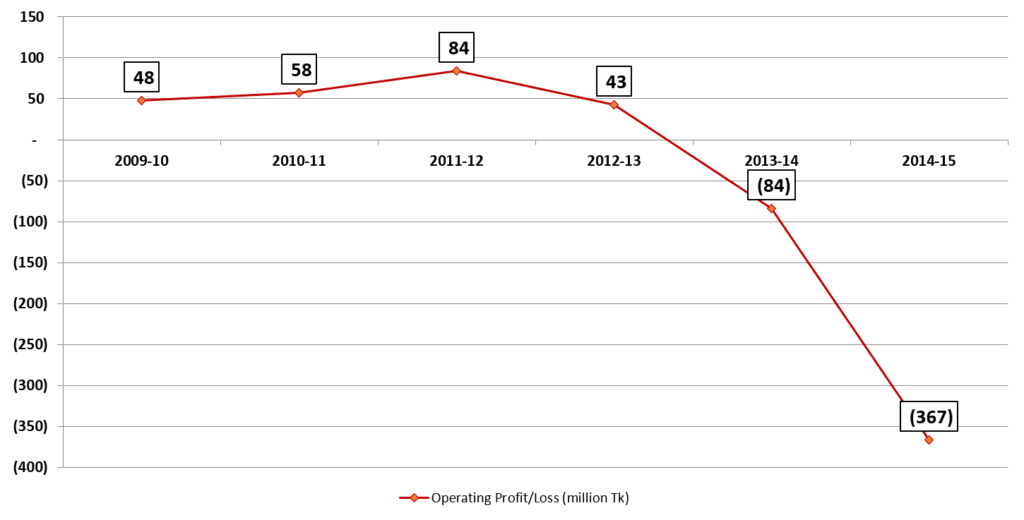

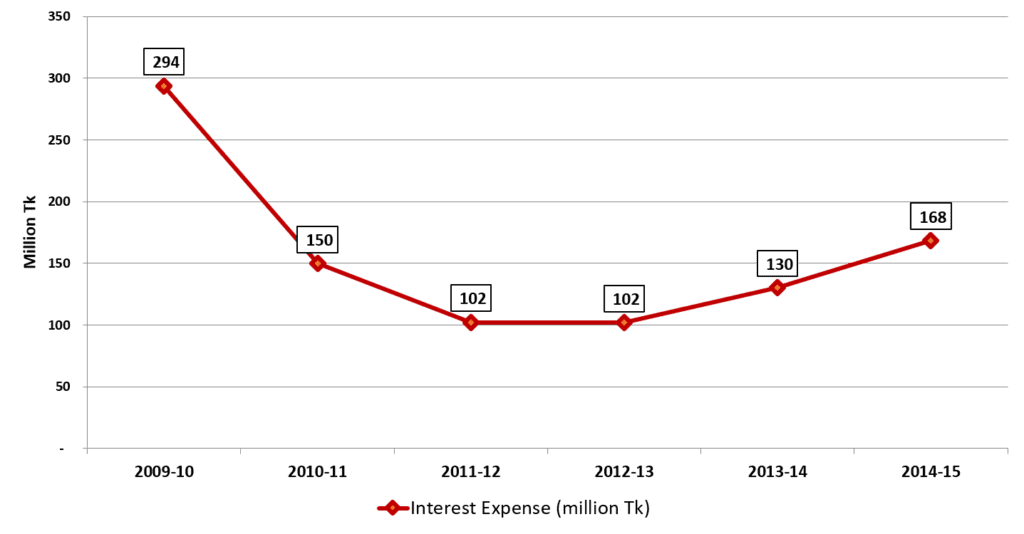

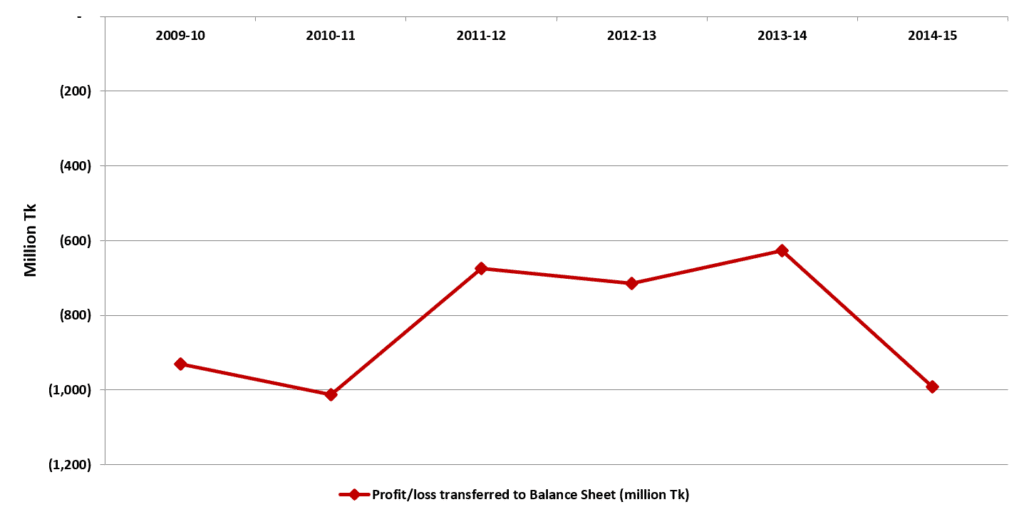

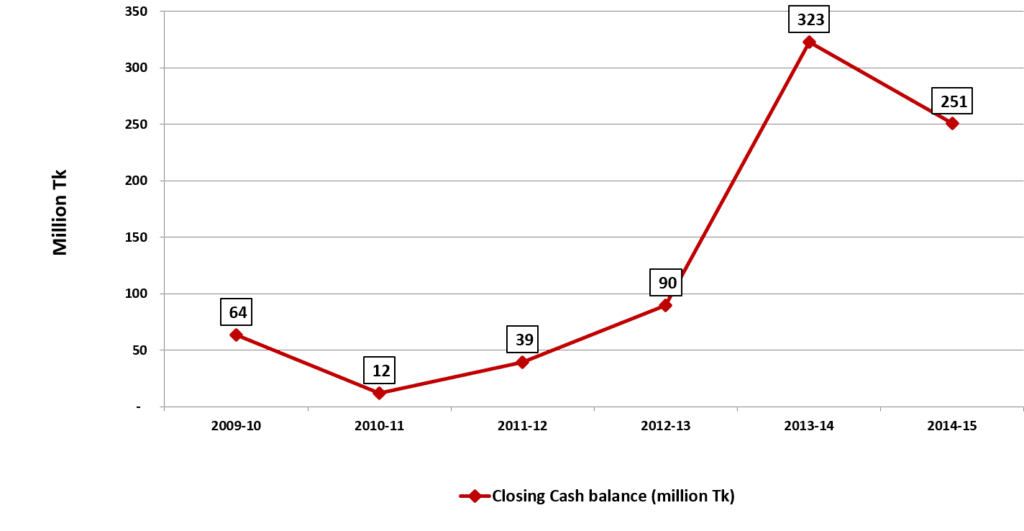

Why MGMCL is Facing Loss

- Low Production Volume

- Granite Deposit under Aquifer (groundwater reservoir)

- Unfavorable GTC Contract

- Dollar valuation

- Contradictory motivation of MGMCL and GTC

- High Debt to Equity Ratio

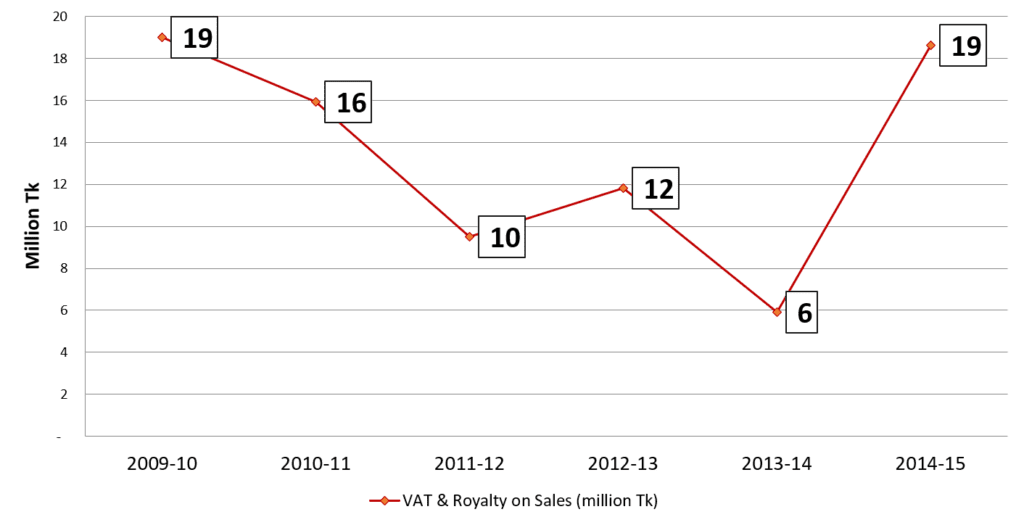

- VAT and Royalty on Sales

- Indian Market Control Tactics

- Lack of Marketing Strategy

- Two Core Issues in Marketing of MGMCL

- Lack of Production Planning

Marketing Strategy and Implementation Guideline

Marketing Strategy

- Alternative 1: Mass Marketing

- Alternative 2: Segmented Marketing

- It is recommended that MGMCL follows mainly a Segmented Marketing Strategy.

Justification

- PRODUCTION CAPACITY

MGMCL does not cover a large enough production to enjoy economies of scale by selling to everybody.

- QUALITY VARIATION OF MARKET

Quality of Maddhapara rock is quite high (16000 PSI). In many cases this level of quality is not required. Therefore, some customer seeks lower quality goods at lower price. MGMCL will not have any advantage there. However, some clients look for high quality rock and are likely to prefer MGMCL rock over others.

- NEED FOR CUSTOMER PRIORITIZATION

From previous analysis (Key Customers), it is found that one third of company’s customers are responsible for three-quarter of total sales volume. This means, business of MGMCL is driven by a few customers – not by every customer they have. A better relationship with these customers will ensure that they will consider MGMCL in more of their projects and given enough priority, they will prioritize MGMCL over other sources. Opportunity to build relationship is high for MGMCL.

Guideline to Implement Strategy

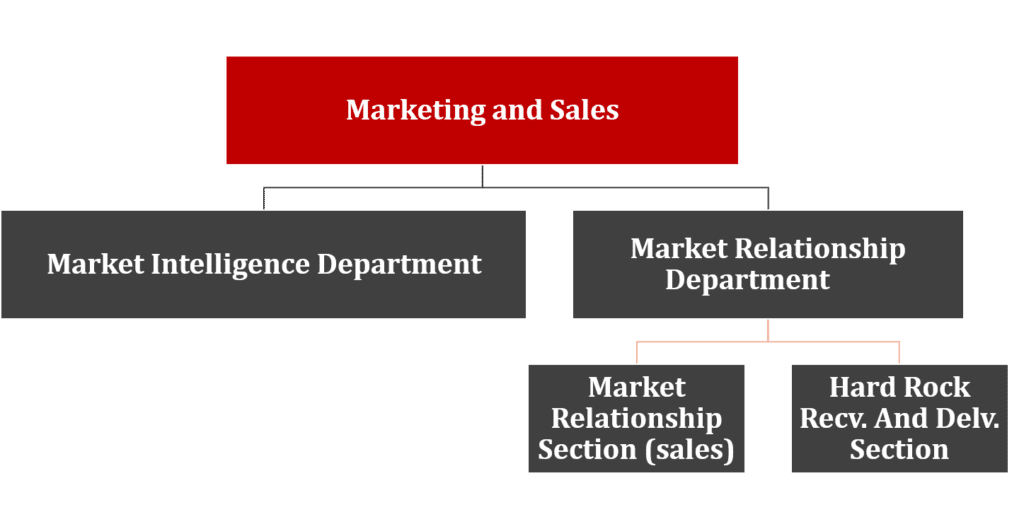

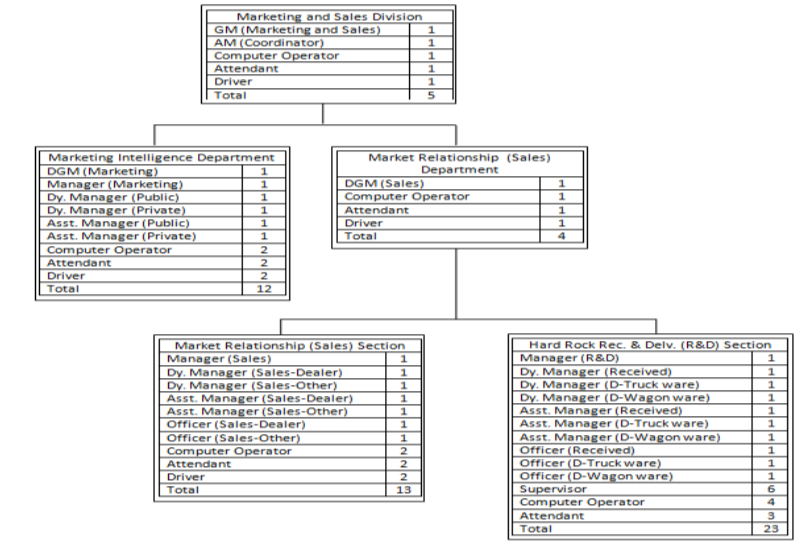

- REFORMATION OF MARKETING DEPARTMENT

- IDENTIFY SEGMENT AND DEFINE BENEFIT

- SALES & OPERATIONS PLANNING

- GEOGRAPHIC EXPANSION

- INDIAN PRACTICE VS AUGMENTED FACILITIES

- MANPOWER REQUIREMENT FOR IMPLEMENTATION

- ALTERNATIVE SUGGESTION TO MARKETING DIVISION

Recommendations

- Transportation of Stone by Railway–Waterway

- Improvement of Marketing Policy

- Liaison with Govt. Organizations for promoting Stone Marketing

- Exemption of Duty/Tax/VAT

- Conversion of Loan into Equity and Exemption of Interest

- Security

- Trading as an Business Option

- Capacity Building

- Consistent Leadership

- Value Addition in Hard Rocks

- Employee Motivation Initiatives

- Inclusion of Public Sector Stakeholders in the Board of MGMCL

- Participation in the Inter Ministerial Meeting with Stakeholder Ministries

- Pricing Methodology

- Introducing e-Commerce

- Construction of an Explosive Factory